Community

Association

Offshore Survey

(

prepared by

Kerry Borthwick

for and on behalf of

SIRA & WPCA

May

2007

1. background

The Scotland Island Residents Association (SIRA) and the West Pittwater Community Association (WPCA) wanted to ensure they understood members’ needs and wishes in order to be able to represent them effectively generally and particularly in respect of negotiations with the Department of Lands and Pittwater Council regarding proposed changes to the Church Point Precinct.

Accordingly it was determined that conduct of a survey to identify demographic characteristics of the offshore community together with their transport and parking needs, and views on proposed changes to the Church Point precinct would be an appropriate undertaking.

2. methodology

2.1

Confidentiality

An undertaking was given to the offshore community that the survey would be confidential, whereby their privacy would be maintained in respect of access to the raw data and only aggregated data results would be reported.

2.2

Questionnaire Design

The questionnaire was designed by a sub-committee of representatives of both the offshore residents’ associations, ie the West Pittwater Community Association (WPCA) and the Scotland Island Residents Association (SIRA). Members were as follows:

Ian Souter (Committee Member, SIRA)

Greg Roberts (Committee Member, SIRA)

Bill Gye (Member, SIRA)

Michael Wiener (President, WPCA)

Shar Jones (President, SIRA)

The questionnaire was designed in two parts:

· Part A was similar to a census and solicited general demographic information relevant to offshore residents, including suburb; residential status; age; type of residence (eg whether primary residence or weekender); number of vehicles on and offshore and where they park; commuter boat numbers and mooring locations; types of transportation used on the mainland; main destinations on the mainland; public transport requirements; barriers to use of public transport; primary interchange; car pooling etc

·

Part B sought information on offshore residents’

views on the Cargo Wharf at Church Point; parking along the roadway between the

mini-market and Holmport Marina; the pontoon and heritage wharf at Thomas Stephens

Reserve; alternative dispersal points

for car parking other than Church Point; the current Church Point carpark;

preferred type of structure if a new

carpark built; whether they are able and/or prepared to purchase parking

space(s); current commuter boat mooring locations offshore

Prior to finalisation the draft survey was tabled at a Church Point Precinct Design Group meeting attended by representatives of Pittwater Council, SIRA and WPCA and the two onshore residents’ groups, ie Bayview-Church Point Residents Association (BCPRA) and the Church Point Reserve Association (CPRA). The purpose and content of the survey was discussed and the reason for the survey design being in two parts was discussed. Points arising from the discussion were taken into consideration in finalising the questionnaire.

2.3 Distribution

The questionnaires were printed by Pittwater Council who also provided a return stamped addressed envelope to facilitate return of completed surveys.

WPCA and SIRA Presidents, Michael Wiener and Shar Jones, individually signed a covering letter on behalf of both associations, addressing confidentiality and explaining the survey rationale (copy of letter attached as appendix 1).

Surveys were mailed out by

SIRA and WPCA. Surveys were sent to all

property owners resident in

Distribution numbers are outlined in Table 1 below:

|

Table 1: Survey Distribution |

|||

|

Association |

No.Owners |

No.Renters |

Total |

|

SIRA |

|

|

|

|

|

351 |

52 |

403 |

|

|

|

|

|

|

WPCA |

|

|

|

|

|

56 |

|

|

|

(inc. Little Lovett) |

68 |

|

|

|

|

23 |

|

|

|

McCarrs Creek |

22 |

|

|

|

|

- |

24 |

193 |

|

|

|

|

|

|

Total Surveys Distributed |

|

|

596 |

Surveys were initially requested to be returned by 26 March, however due to an initial slow response rate, follow up requests were made via the Pittwater Offshore Newsletter and notices in public places such as at wharves, and the return date was extended until completion of data entry on 30 April 2007.

2.4 Response Rate

When survey return was closed, the following numbers had been received and the response rates calculated (on the basis of surveys returned as a percentage of surveys distributed) as follows:

|

Table 2: Survey Response |

||

|

Association |

Total No. Returned |

Response Rate % |

|

SIRA |

|

|

|

|

216 |

53.6 |

|

|

|

|

|

WPCA |

|

|

|

|

37 |

66.1 |

|

(inc. Little Lovett) |

44 |

64.7 |

|

|

19 |

82.6 |

|

McCarrs Creek |

3 |

13.6 |

|

|

1 |

n.a. |

|

|

193 |

53.9 |

|

|

|

|

|

Total Offshore |

330 |

55.4 |

The overall response rate as displayed in table 2 above was 55.4%. Although the result is lower than hoped for, 55.4% is an outstanding response rate for a mail out survey.[1]

It should be noted that the

overall response rate between

An analysis of the response rate relative to owners vs renters revealed a similar result to the overall response rate:

|

Table 3: Owner/Renter Response |

||

|

Residential Status |

Total No. Returned |

Response Rate % |

|

Owner |

281 |

54.0 |

|

Renter |

42 |

55.3 |

|

Residential Status unspecified |

7 |

|

2.5 Analysis and Interpretation

Data entry was undertaken on

a PC and input into an Excel file. It

was then transferred into the software package used for the data analysis.

The analysis was undertaken using the Statistical Package for the Social Sciences, ie SPSS (V14.0), on a university mainframe computer via a remote PC. The data analyst was Ms Kerry Borthwick[2], Director of Quality of Working Life Pty Ltd.

3.

RESULTS

The results are presented below in the format of the questionnaire interspersed with comments on their interpretation where appropriate.

3.1 OFFSHORE SURVEY: PART A

DWELLING

1. FAMILY NAME(S) Confidential

2. (a) STREET NUMBER

& STREET Confidential

SUBURB

ELVINA BAY 11.2%

LITTLE LOVETT 2.1

LOVETT BAY 11.2

McCARRS CREEK 0.9

MORNING BAY 5.5

OFFSHORE (unspecified) 3.3

Graph 1

(b)

(c)

CONTACT DAYTIME PHONE NUMBER Confidential

3. RESIDENTIAL

STATUS

OWNER 85.2%

RENTER 12.1

BOARDER 0.3 97.6%

Graph

2

4. NUMBER OF OCCUPANTS RESIDING AT THIS

ADDRESS Mean 2.7

Median 2

Sum

883

Range

1 – 9 persons

Graph 3

Occupants x households

5. AGE

OF EACH PERSON/OCCUPANT:

Mode 51-60 years

Range

0- >70 years

0 – 5 YEARS 7.9%

6 - 10 YEARS 6.2

11 – 14 YEARS 5.1

15 – 17 YEARS 5.3

18 – 20 YEARS 3.5

21 – 30 YEARS 5.6

31 – 40 YEARS 13.5

41 – 50 YEARS 17.0

51 – 60 YEARS 18.7

61 – 70 YEARS 12.3

OVER 70 YEARS 4.8

The modal age of survey respondents is 51 to 60 years. There are 19.2% of respondents under 15 years and 19.1% over 60 years (seniors).

It is intuitively believed that the

offshore population demographic is changing in a number of ways, not the least

of these being the trend for people to continue to live offshore until older

ages than previously. Add to this the

acknowledged aging population in

The modal age group in the Offshore Survey is the 51-60 age group. This is the “baby boomers” generation given that the “baby boomers” commenced being born following the end of World War II (1946) and the next cohort generation commenced in 1965. Thus the oldest “boomers” were turning 60 last year and attained senior citizen status. That the 51-60 age group is the modal group is significant in terms of access considerations for a large number of offshore residents over the next few years.

Despite there having been a census

in 2006 it will be some time before detailed information is available down to

the locality level. The current census

information available at this level is from the 2001 census. This census data was compared to the survey

information in respect of age. The 2001

Census data for

Table 3 below presents the comparative data:

|

Table 4: Offshore Survey comparison with 2001 Census |

|||||

|

|

Survey |

2001 Census |

|||

|

Age group |

|

|

|

Pittwater |

Church Pt |

|

%

less than 15 yrs |

19.3 |

20.8 |

25.3 |

19.6 |

15.7 |

|

%

15 yrs & over |

80.7 |

79.2 |

74.7 |

80.4 |

84.3 |

|

%

over 60 yrs |

17.0 |

14.7 |

5.2 |

14.0 |

16.9 |

|

%

over 70 yrs |

4.7 |

3.4 |

1.2 |

9.7 |

8.2 |

|

Total

no. persons |

881 |

594 |

731 |

52377 |

1121 |

Observation of the data contained in Table 3 reveals a number of interesting comparisons:

·

· The percentage of Scotland Islanders over 60 years is almost 3 times that of the Scotland Islanders in the 2001 Census, and the percentage of Scotland Islanders over 70 years has also almost tripled since 2001. Both these results are in line with general population trends and have significant bearings on access issues as discussed in relation to the modal group and “baby boomers”, however the “over 60’s” have already attained “senior citizen” status. Accordingly decisions on parking need to account for the increasing accessibility needs of offshore seniors.

· Scotland Island age results are very similar to the overall offshore population age results indicating that the island and western shore communities tend to be similar in this demographic.

·

The population of Church Point in 2001 was 1121

and the population of

· The age comparisons between the offshore population as revealed in the 2007 survey responses and the overall Pittwater population in 2001 (census) are almost equivalent with the exception of a lower percentage of persons over 70 years. This is interesting and could suggest a lag effect which would be worth checking when the 2006 census data is available. The reason for this comment is that it could assist in developing models for predicting offshore population demographic changes.

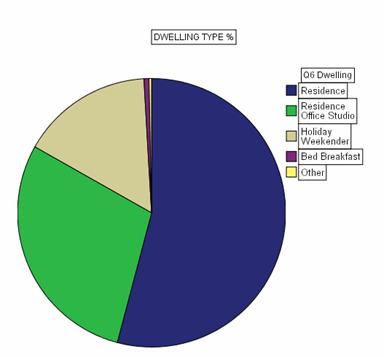

DWELLING

6. USE OF DWELLING:

RESIDENCE 53.6% Residence and home office/studio etc. 28.8

HOLIDAY/WEEKENDER 15.8

BED & BREAKFAST (B & B) 0.6

OTHER 0.3

NOT SPECIFIED 0.9

Note: “Other” cited was “Youth Hostel”.

Graph 4

7. If you

answered YES to HOLIDAY/WEEKENDER, please enter the

AVERAGE DAYS’ OCCUPATION PER MONTH Median 8 days

Modes 8, 10

days

Range 1 – 20 days

CARS

8.

TOTAL NUMBER OF VEHICLES

(CARS/TRUCKS) Total 319

PER PROPERTY ONSHORE AND OFFSHORE Median 2

(ie

including motor cycles) Mode 2

Range

1-9

9. NUMBER OF VEHICLES

(excluding motor cycles) USUALLY

PARKED:

(a) AT CHURCH POINT Total 283 Median 1

Mode 1

Range 1-4

It must be remembered that 283 vehicles only represents vehicles owned by 55.4% of offshore residents and that using this proportion as a base, it could be estimated that there would be more than 500 vehicles belonging to the offshore community requiring public parking in the vicinity of Church Point.

(b) ELSEWHERE ON SHORE Total 67

Median 1

Mode 1

Range 1-4

Similarly to the comment in Q9(a), an estimated 120 vehicles owned by members of the offshore community would be parked elsewhere on shore.

10. NUMBER

OF vehicles used ON MAINLAND for work Total 123

PURPOSES

to transport tools, equipment, Median 1

materials

etc. Mode 1

Range 1-4

11. NUMBER OF VEHICLES PARKED OFFSHORE:

(a)

CARS Total 26

Median 1

Mode 1

Range 0-2

(b)

TRUCKS Total 6

Median 1

Mode 1

Range 1-2

(c)

MOTOR CYCLES Total 13

Median 1

Mode 1

Range 1-2

The vast majority of these vehicles

are located on

BOATS

12. NUMBER OF COMMUTER BOATS PER HOUSEHOLD Total 290[3]

Median 1

Mode 1

Range 1-4

13. NUMBER OF COMMUTER BOATS MOORED AT CHURCH

POINT Total 226

Median 1

Mode 1

Range 1-4

The majority, but not all of these

boats moor at the

14. (a) NUMBER

OF COMMUTER BOATS MOORED AT Total 70

OTHER DISPERSAL POINTS Median 1 Mode 1

Range 0-3

(b)

If you entered a number forQ14(a):

PLEASE IDENTIFY THE RELEVANT DISPERSAL POINTS:

Responses included:

Holmport Marina, Quays Marina, Bayview Anchorage/Gibsons Marina.

Royal Motor Yacht Club, Royal Prince Alfred Yacht Club

The various dispersal points mentioned also provide parking for boat owners’ vehicles which is a prime reason for renting a berth. The costs of renting commuter boat berths at the various marinas and/or clubs can exceed $5000/year. There are also waiting lists for places.

COMMUTER DETAILS (per person)

15. AVERAGE

No. OF DAYS COMMUTING PER WEEK (PER

PERSON) median 5 Mode

5

Range

1-7

16. MODES OF TRANSPORTATION TO/FROM THE MAINLAND BY

WATER (PER PERSON)

Please rank in order of frequency of use. If you don’t use a particular mode, please

leave it blank. For example if you

mostly travel by motor boat you would give that a rank of 1, and then if you

travel next most often by ferry, you would rank that as 2, and if you travel

least often by water taxi you would give it a rank of 3. Finally if you never travel by

rowboat/canoe/kayak you would leave that option blank

. Rank No. Persons Using Mode

ROW BOAT/CANOE/KAYAK 4 48

MOTOR BOAT (INCLUDING TINNIES) 1

286

FERRY 2 273

WATER TAXI 3 46

17. MODES

OF TRANPORTATION ON THE MAINLAND (per person)

Please

rank in order of frequency of use (as for Q16 above). If you don’t use a

particular mode please leave

it blank. Please don’t include walking

from the wharf to your car at Church Point.

. Rank No. Persons Using Mode CAR 1 770

VAN/SMALL TRUCK 8

36

MOTORBIKE 9 17

PUSH BIKE 7 50

BUS 2 292

TAXI 4 103

TRAIN 5 61

WALK 3 131

18. MAINLAND

DESTINATION

We would like

to obtain an idea of the directions people travel on the mainland in order to

understand transport and parking needs.

PLEASE

ENTER THE POSTCODES OF YOUR THREE MOST FREQUENT DESTINATIONS

Mode

2103

Range

1635-2790

Rank (First 10) Postcode Location Percentage

1 2103 Mona Vale 17.8%

2 2000

3 2106

4 2105 Church Point

5.2

5 2107 Avalon Area

3.2

6 2100 Brookvale

Area

3.4

7 2099

8 2101 Narrabeen

2.0

9

) 2065 Crows

Nest ( 1.9

) 2095

) 2102 Warriewood (

1.9

The most frequent destination reported was Mona Vale, this is a typically expected response as it is not only the nearest shopping precinct to the offshore community but is the location of Mona Vale Public School, Pittwater High School, Sacred Heart Primary School, banks, churches, childcare facilities, sporting fields and gymnasiums.

The next most significant destination recorded was the Sydney CBD reflecting work related commuting with a lesser influence from social activities on weekends. Lack of appropriate direct public transport from Church Point to the City is a cause of concern due to limitations on the hours of operation. For instance the first ferry which picks up from all island wharves arrives at Church Point at 7:25am and the peak hour bus to the Sydney CBD now arrives at the Point at approx 7:45am. Although it is timetabled to arrive at Central around 8:45am, it is a rare occurrence for it to arrive in the city before 9:00am. Naturally this presents a problem for CBD workers. Examining the situation for return from the city the last direct bus from the CBD leaves Central at approximately 5:30pm and is timetabled to arrive at Church Point at 6:47pm in time to meet the last ferries stopping at all the offshore wharves. Again traffic delays often result in commuters using this bus missing the 7:00pm ferries and have to resort to water taxis at upwards of $20/trip. In order to avoid these problems a number of commuters drive to Mona Vale and leave their vehicles there in order to catch express buses to the city to enable them not only to arrive at work on time but get home.

SCHOOL FERRIES AND BUSES (per

person)

%

Persons

19. DO YOU TRAVEL ON THE SCHOOL FERRY

TO AND FROM

20. DO YOU TRAVEL ON A SCHOOL BUS

TO AND FROM CHURCH POINT 12.4%

PUBLIC TRANSPORT (per person)

21. WHAT

HOURS DO YOU REQUIRE PUBLIC

TRANSPORT

TO OPERATE?

% All Acceptable Options

24 HOURS/DAY MONDAY-FRIDAY 26.7%

24 HRS SATURDAY/SUNDAY 24.5%

5:00AM – 1:00AM MONDAY-FRIDAY 49.4%

6:00AM – 3:00AM SAT/SUN 36.4%

22. WHAT

FREQUENCY DO YOU NEED

PUBLIC

TRANSPORT TO OPERATE?

%

All Acceptable Options

(a) CHURCH

POINT-CITY RETURN

PEAK HOURS WEEKDAYS

29.7%

HOURLY WEEKDAYS 37.0%

HOURLY WEEKENDS 36.4%

MORE THAN ONCE AN HOUR ON WEEKDAYS 29.4%

MORE THAN ONCE AN HOUR ON WEEKENDS 17.9%

(b)

HOURLY WEEKDAYS 20.9%

HOURLY WEEKENDS 20.3%

MORE THAN ONCE AN HOUR ON WEEKDAYS 9.4%

MORE THAN ONCE AN HOUR ON WEEKENDS 13.9%

DO NOT NEED TRANSPORT TO MANLY

WHARF 15.2%

(c) CHURCH

POINT-CHATSWOOD RETURN

PEAK HOURS WEEKDAYS 17.0%

HOURLY WEEKDAYS 13.9%

HOURLY WEEKENDS 11.2%

23. WHICH

OF THE FOLLOWING CURRENTLY PREVENT YOU

USING

PUBLIC TRANSPORT?

Note

Rank and No of Persons are not equivalent comparisons.

Rank No. Persons Citing Reason

NEED TO TRANSPORT PETROL OR LPG 7 87

NEED TO TRANSPORT ANIMALS 9

61

NEED TO TRANSPORT LARGE OBJECTS

(PLANTS, HOUSEHOLD GOODS) 5 161

NEED TO TRANSPORT WORK RELATED

TOOLS/EQUIPMENT

8 72

NUMEROUS SHOPPING BAGS 2 272

TIME CONSTRAINTS 1 331

TRANSPORT DOES NOT SERVICE MY

REQUIRED

DESTINATIONS 3 283

LACK OF EXPRESS BUSES 6 191

INFREQUENT

SERVICE 4 279

OTHER

10 30

Most common reasons for “Other”: Difficulties with young children; inability to take children to child care and then get to work on time and pick up children from child care before it closes if using public transport; limited peak hour buses to and from city; problems with catching buses if working at North Sydney etc, ie connecting buses full and don’t stop; undertake shiftwork; no buses after midnight; poor coordination with Church Point ferries.

24. PRIMARY

INTERCHANGE (PER PERSON)

Please

tick transport interchange terminus per person Rank Percentage

CHURCH POINT 1 86.8%

BAYVIEW

OTHER DISPERSAL POINTS 2 9.7

25.

TOTAL ONE WAY TRIPS (per person) Mode Range Percentage[4]

(a)

TO CHURCH POINT PER WEEK 6 1-12 39.2%

(b)

FROM CHURCH POINT PER WEEK 6 1-12 9.6

(c) TO OTHER DISPERSAL POINTS PER WEEK 1

1-12 40.2

(d) FROM OTHER DISPERSAL POINTS PER WEEK 1 1-12 11.0

26. CAR POOLING (per person) % Persons

(a) ARE YOU CURRENTLY INVOLVED IN CAR POOLING 7.6% involved

AS A PASSENGER OR DRIVER?

(b) WOULD

YOU BE INTERESTED IN PARTICIPATING 16.7% interested

IN ORGANISED CAR POOLING

27. COMMUNITY

CAR SHARING (per person)

A new approach to commuting has been set up in Manly and

other local government areas.which involves car sharing. A commercial organisation provides a number

of vehicles and users pay a monthly fee together with a fee for the amount of

time and mileage used. Information is

available on www.goget.com.au

% Persons

WOULD YOU BE INTERESTED IN CONSIDERING

THIS TYPE OF CONCEPT AS AN OPTIONAL 22.4% interested

ALTERNATIVE FORM OF TRANSPORT?

.

OFFSHORE SURVEY: PART B

The following questions relate to the Options outlined in the Church

Point Plan of Management – Issues and Options Paper, December 2006

They should only be answered by ADULT members of each household.

Please tick each of the following statements you AGREE with :

(A = Adult 1, 2 etc) Please tick

if YES % Adults ‘Yes’

28. CLOSE

AND

TO ROWLAND RESERVE

9.7%

29.

APPOINT AN

ON-SITE MANAGER/RANGER, AT THE

OFF-SHORE COMMUNITY’S EXPENSE, TO REGULATE 7.6%

THE USE OF

COMMUTER BOAT TIE UP

30. INSTALL

A SECURITY AND SURVEILLANCE SYSTEM 31.8%

31. PROVIDE A FENCED STORAGE AGREA BESIDE THE

WHARF

THAT COULD BE LEASED TO OFFSHORE RESIDENTS? 18.8%

32. PROVIDE A

ROADWAY between

MINI-MARKET and HOLMPORT

Please tick if YES % Adults “Yes’

33.

ESTABLISH BETWEEN

40 AND 50 CARPARKING SPACES

ALONG THE CLIFF EDGE 39.1%

34.

ESTABLISH BETWEEN

40 AND 50 CARPARKING SPACES 25.5%

ALONG THE WATERFRONT

35.

ESTABLISH BETWEEN

80 AND 100 CARPARKING SPACES

ALONG THE CLIFF EDGE AND THE WATERFRONT 69.4%

THE

POINT/PASADENA (per adult)

36. WHEN THE

LEASE ON THE GREEN AREA IN FRONT OF THE

Please tick

if YES

% Adults ‘Yes’

(a) DO NOT RENEW THE LEASE AND RETURN THE LAND TO

OPEN

PUBLIC SPACE? 54.5%

(c) FURTHER LIBERALISE THE LEASE TO PROVIDE INCREASED

COMMUNITY ACCESS? 47.6%

THOMAS STEPHENS RESERVE (per adult)

Please tick if YES % Adults ‘Yes”

37. LEAVE THE TEMPORARY PONTOON WHERE IT IS? 37.6%

38. RELOCATE THE TEMPORARY PONTOON TO THE OTHER

SIDE OF

THE

STEPHENS RESERVE TO THE

GENERAL

STORE AND

Please tick

if YES % Adults ‘Yes’

39. REFURBISH

THE OLD WHARF AS PER THE DRAFT 2004

MASTER PLAN? 73.9%

CARPARKING AREA (per vehicle)

40. AS AN

ALTERNATIVE TO CHURCH POINT WOULD

ANY OF THE

DISPERSAL ZONES BELOW BE A SUITABLE

PERMANENT OPTION IF A

COMMUTER PONTOON AND

PARKING WAS

MADE AVAILABLE? Please tick all suitable

alternatives..

(V = Vehicle 1, 2 etc) Preference

Rank Percentage Suitable

BAYVIEW PUBLIC WHARF 2 22.9%

ROWLAND RESERVE BOAT RAMP 3 13.2

McCARRS CREEK RESERVE 4 1.3

NONE OF THE ABOVE 1 40.6

OTHER (Please specify): 6 1.8

Suggestions

for other alternative dispersal zones included

% Vehicle Owners ‘Yes’

41. DO YOU PREFER TO LEAVE THE

CARPARK AS IT IS? 50.3%

42.

WOULD YOU BE

PREPARED TO PAY AN ANNUAL FEE

OF APPROXIMATELY $150 PER VEHICLE FOR

NON-EXCLUSIVE USE OF THE EXISTING CARPARK 44.2%

AND A BOAT SPACE AT THE

Please

tick if YES

43. IF A CARPARK

WAS TO BE CONSTRUCTED WHAT TYPE

WOULD YOU

PREFER? (Please rank in order of preference. If

you don’t

want a particular type of carpark, please leave it blank).

UNDERGROUND 13.3%

HALF IN HALF OUT 22.1%

ABOVE GROUND 26.7%

NO PREFERENCE

26.4%

pLEASE

ANSWER QUESTION 44 ON A PER HOUSEHOLD BASIS:

44. If a carpark was built would YOU WANT TO BUY?

(a) an underground

exclusive use FREEHOLD

(STRATA TITLE) or long term (eg 50 year)

leasehold car parking SPACE costing

APPROXIMATELY $85,000 - $100,000 initial cost AND

WITH A MANAGEMENT, MAINTENANCE and 1 space = 5.5%

REPLACEMENT lEVY OF approximately 2 SPACES = 2.7%

$2000 PER YEAR?

If

YES please nominate number of spaces TOTAL SPACES = 36

(b) a partially

in ground exclusive use OR

FREEHOLD (STRATA

TITLE) or long term

(eg 50 year) leasehold car

parkingSPACE 1 SPACE = 11.5%

costing APPROXIMATELY $50,000 to $75,000 2 spaces = 5.2%

initial cost AND WITH A

MANAGEMENT, 3

SPACES = 0.3%

MAINTENANCE & REPLACEMENT

lEVY OF

APPROXIMATELY $500 PER YEAR? total spaces = 75

If YES please

nominate number of spaces

(c) AN above ground

FREEHOLD (STRATA TITLE) or

or long term (eg 50 year) leasehold car

parking SPACE costing APPROXIMATELY 1 space = 20.9%

$35,000 to $50,000 to purchase AND WITH 2 spaces =

11.8%

A MANAGEMENT,

MAINTENANCE & REPLACEMENT 3

spaces = 0.9%

lEVY OF APPROXIMATELY $250 PER YEAR? 4 spaces = 0.3%

Please nominate number of spaces if YES

TOTAL SPACES = 160

45 IF

YOU ANSWERED YES TO THE PURCHASE OF A

PARKING

SPACE, WHERE DO YOU CURRENTLY PARK

Please

respond for each vehicle you would

purchase a

parking space

for.

CHURCH POINT PRECINCT

PARK

AT CHURCH PT X PURCHASE UNDERGROUND = 72.4%

(26/36 SPACES)

PARK

AT CHURCH PT X PURCHASE PARTIAL INGROUN = 78.9%

(59/75 SPACES)

PARK

AT CHURCH POINT X PURCHASE ABOVE GROUND = 82.9%

(133/160 SPACES)

OTHER AREA

PARK

OTHER AREA X PURCHASE UNDERGROUND = 27.6%

(10/36 SPACES)

PARK

OTHER AREA X PURCHASE PARTIAL INGROUND = 21.1%

(16/75 SPACES)

PARK

OTHER AREA X PURCHASE ABOVE GROUND = 17.1%

(27/160

SPACES)

Intention to purchase by currently parking location is depicted in Graph 5 below:

Graph 5

Equity

Issues Relevant to Purchase of Car Spaces:

It was hypothesised that there may be differences in ability and willingness to purchase car spaces. Such differences may relate to age of the householder (eg young families and./or older people such as retirees); renters vs owners (eg absent owners may not wish to purchase a space or may need to increase rents to cover costs of such a purchase); owners of waterfront properties who may have higher household incomes etc.; owners of weekenders/holiday homes

If such differences are indicated by the survey data it could potentially be extremely divisive to the offshore community.

These propositions were investigated and the findings are reported below.

1.

Age and Ability/Willingness

to purchase car space

1.1

Young families

“Young families” was defined as a household with at least one child aged between 0 and 10 years. Seventy-three households responding to the survey met this criterion equating to 22.1% of respondent households.

1.1.1 Underground

FAMILY

WITH >= ONE CHILD 0-10 YEARS X PURCHASE SPACES UNDERGROUND

= 2 INTENDING TO PURCHASE 1 SPACE

+ 4 INTENDING TO PURCHASE 2

SPACES

= 8

ie A TOTAL OF 10

out of 36 SPACES OR 27.8%

OF SPACES

or

1.1.2 Part In Ground

FAMILY

WITH >= ONE CHILD 0-10 YEARS X PURCHASE SPACES PARTIALLY INGROUND

= 8

INTENDING TO PURCHASE 1 SPACE

+ 4 INTENDING TO PURCHASE 2 SPACES

= 8

+ 1 INTENDING TO

PURCHASE 3 SPACES

= 3

ie A TOTAL OF 19

out of 75 spaces OR 25.3% OF SPACES

or

1.1.3 Above Ground

FAMILY

WITH >= ONE CHILD 0-10 YEARS X PURCHASE PACES ABOVE GROUND

= 22 INTENDING TO PURCHASE 1 SPACE

+ 10 INTENDING TO PURCHASE 2 SPACES

= 20

+ 1 INTENDING TO PURCHASE 3 SPACES

= 3

+ 1 INTENDING TO PURCHASE 4 SPACES

= 4

ie

A TOTAL OF 49 out of

160 SPACES OR 30.6% OF SPACES.

Examination of the results through comparison of the intention to purchase calculations with the group population proportion did not indicate a significant purchasing disadvantage from the “young family” population group.

1.2

Seniors

Traditionally, “seniors” are persons aged 60 years or

more. Given that our survey categories

do not match exactly with this traditional group, “seniors” in the survey group

are those members of the offshore community who are aged from 61 years. This results in an under-estimation of the

offshore “senior” population which should be taken into consideration when

making decisions based on the findings in respect of the aging offshore

population and their needs.

The number of households responding to the survey

which meet the criterion of at least one (“senior”) member of the household

aged 61 years or more was 108 equivalent to 32.7% of respondent households.

1.2.1 Underground

RESIDENCE WITH.>= ONE

RESIDENT OVER 60 YEARS X PURCHASE SPACES

UNDERGROUND

= 2 INTENDING TO PURCHASE 1 SPACE

+ 2 INTENDING TO PURCHASE 2 SPACES

= 4

ie A TOTAL OF 6

out of 36 SPACES OR 16.7%

OF SPACES

or

1.2.2 Part In Ground

RESIDENCE

WITH .>= ONE RESIDENT OVER 60 YEARS X PURCHASE SPACES PARTIALLY INGROUND

= 5

INTENDING TO PURCHASE 1 SPACE

+ 4 INTENDING TO PURCHASE 2 SPACES

= 8

ie A TOTAL OF 13

out of 75 spaces OR 17.3% OF SPACES

or

1.2.3 Above Ground

RESIDENCE

WITH .>= ONE RESIDENT OVER 60 YEARS X PURCHASE SPACES ABOVE GROUND

= 14 INTENDING TO PURCHASE 1 SPACE

+ 6 INTENDING TO PURCHASE 2 SPACES

= 12

+ 1 INTENDING TO PURCHASE 4 SPACES

= 30

ie

A TOTAL OF 56 out of 160 SPACES OR 35% OF SPACES.

It is clear from the preceding calculations that the

“senior” group is disadvantaged in respect of intent/ability to purchase

underground or partially above ground car spaces however this is not the case

(for the group as a whole) in respect of above ground spaces.

A comparison between the two age conditions and ability/willingness

to purchase a car parking space in each of the three built options is

delineated below:

Graph 6

2. Waterfront Properties

Given that this question was not directly asked, it is not possible to determine a definitive answer however the majority of waterfront owners could be expected to moor their tinnies at private jetties rather than at public wharves or beaches offshore.

In this respect, 143 respondents report having at least one boat moored on a private jetty and 132 respondents report having at least one boat moored at a public wharf or on a beach, or 52% and 48% respectively.

The data showed:

2.1 Underground

MOOR BOAT PRIVATE JETTY X

PURCHASE SPACES UNDERGROUND

= 13 INTENDING TO PURCHASE 1 SPACE

+ 2 INTENDING TO PURCHASE 2

SPACES

= 4

ie A TOTAL OF 17

out of 36 SPACES OR 47.2%

OF SPACES

or

2.2 Part In Ground

MOOR

BOAT PRIVATE JETTY X PURCHASE SPACES PARTIALLY INGROUND

= 26

INTENDING TO PURCHASE 1 SPACE

+ 11 INTENDING TO PURCHASE 2 SPACES

= 22

+ 1 INTENDING TO

PURCHASE 3 SPACES

= 3

ie A TOTAL OF 51

out of 75 spaces OR 68% OF SPACES

or

2.3 Above Ground

MOOR

BOAT PRIVATE JETTY X PURCHASE SPACES ABOVE GROUND

=

38 INTENDING TO PURCHASE 1 SPACE

+ 26 INTENDING TO PURCHASE 2 SPACES

= 22

+ 2 INTENDING TO PURCHASE 3 SPACES

= 6

+ 1 INTENDING TO PURCHASE 4 SPACES

= 4

ie

A TOTAL OF 100 out of 160 SPACES OR 62.5% OF SPACES.

Given the assumptions made no formal statistical tests can be undertaken, however from the results presented and comparing these against the 58.6% of boats parked at private jetties (refer response to question 49(a)), no indication of a major difference in intention to purchase can be attributed to “waterfront” vs “non-waterfront” households.

Graph 7 below displays the results of the estimated “waterfront” residents’ intention to purchase car parking spaces:

Graph 7

3. Renting

vs Ownership

Despite the fact that it would be unlikely that a non-owner would be permitted to purchase a car parking space, a series of analyses of variance was carried out to determine whether any significant differences existed.

There were no significant differences between Renters and Owners in respect of intention to purchase underground parking spaces (F1,2 = 1.033; p = 0.357) or partially in ground parking spaces (F1,2 = 0.872; p = 0.419). However there were significant differences between Renters and Owners (as expected) on intention to purchase above ground parking spaces (F1,2 = 5.667; p = 0.004) such that Owners were more prepared to purchase an above ground parking space.

Since the survey did not ask a question regarding landlord owners there was no way of distinguishing whether there were differences in intention to purchase car parking spaces between Resident and Landlord Owners.

3.

Weekender/Holiday Properties

Further analyses of variance were conducted to determine if there were differences in intention to purchase between dwellings used as Owners’ primary residence and those used as weekenders/holiday homes.

There were no significant differences in respect of any of the three conditions, ie intention to purchase underground (F 1,2 = 1.454; p = 0.235; partially in ground (F 1,2 = 2.004; p = 0.136); and above ground (F 1,2 = 0.516; p = 0.597).

PLEASE ANSWER QUESTIONS 46 TO 48

ON A PER HOUSEHOLD BASIS:

46 IF

NO, WHY WOULD YOU BE UNWILLING TO PURCHASE

YOUR OWN SPACE? Please tick all relevant options. % Households

UNABLE

TO AFFORD/UNWILLING TO PAY PURCHASE PRICE 43.6%

UNABLE

TO AFFORD/UNWILLING TO PAY MAINTENANCE LEVY 27.6% DON’T

OWN A VEHICLE 0.6%

HAVE

ALTERNATIVE PARKING 4.2%

DISAGREE

ON PRINCIPLE 40.6%

47.

IF A CARPARK

WAS CONSTRUCTED, WOULD YOU AGREE % Households ‘Yes’

WITH IT BEING MANAGED BY AN OFFSHORE

COOPERATIVE? Please

tick if YES 58.5%

48.

WOULD YOU AGREE

WITH A CAR PARK BEING BUILT

AND MANAGED BY A PRIVATE CARPARKING

COMPANY? 22.7%

Please tick if

YES

Please

answer Question 49 on a per commuter boat basis

49.

Where do you park your

commuter boat off-shore:

(B = Boat 1, 2, 3 etc) Please tick if YES

(a)

Private jetty?

Respondents reported that 234 boats were moored on private jetties, ie 58.6% of offshore commuter boats.

(b)

If you answered YES to

(eg Bells,

There were 33.8% of commuter boats reported moored on public wharves offshore, 135 boats.

No. Boats on Public Wharves

eastern wharf (

elvina bay north wharf 5

It will be observed that the number of boats reported moored on specific public wharves does not equate with the overall number of commuter boats moored on public wharves. This result is due to a number of respondents not providing information on which wharf they moor their commuter boat.

(c) On the beach?

If you

answered YES to On the Beach, please identify the beach

(eg Cargo, Bill’s etc)

Thirty commuter

boats (7.5%) were reported being moored on offshore beaches on

No. Boats on Beach

Elvina

bay beach 2

morning

bay beach 1

tennis beach (

other

beach (UNSPECIFIED) 1

TOTAL

BOATS ON BEACHES 20

Again due to a number of respondents failing to identify a specific beach, there are less boats identified as being moored at specific beaches than reported being moored on beaches in general.

50. ANY

GENERAL COMMENTS OR SUGGESTIONS:

There were a large number of comments and suggestions covering a wide variety of topics relevant to accessing offshore properties. Some comments described the difficulties of access; others proposed solutions to the car parking and/or commuter wharf problems at Church Point; and others raised the notion of social justice and employed comparisons with other council areas’ parking solutions.

A small sample of pertinent comments are included below.

Areas of

Use of car pooling or reducing family car ownership to

1 rather than 2 requires a small storage capability otherwise constant moving

and rearranging of items.

Concern a constructed carpark with purchase options is

divisive – those who can afford vs those who can’t.

Pressure carpark very difficult peak times but

Is there possibility upgrade Tennis? Pontoon needs

replace and extend.

I purchased land in 1957 and built 57-58 and

contributed to commuter wharf when first installed.

Refer past plans submitted by Dermer Bennett

(architect) for carpark/mooring located in McCarrs Creek area.

While I have ticked box purchasing a spot I would find

the capital outlay most difficult and see it only as last resort.

Church Point commuter wharf is a disaster area in

terms of overcrowding/personal inconvenience/boat damage and theft forcing

commuters onto expensive ferry/water taxi options.

Other dispersal points are too far over the water and

subject to weather conditions.

This only addresses the carpark issue. Unless both car

and boat parking issues are addressed, then we are not interested in car space/parking. We prefer to pay a fee to park a commuter

boat and car in serviced space at marinas.

I would like to see a mother & child tinny tie up

at commuter wharf or a separate wharf for mothers & disabled.

Retired owners are unable to contribute.

Simple & cost effective 80/100 extra car spaces

along waterfront & extend commuter boat ramp shop and Holmport.

Toilet block revamp. Men’s toilet has no doors or seats. More disabled parking spots

near Church Point end of car park. Extend commuter wharf cheaper & easier.

If the road

down from west Head was opened to

Has the Council researched the income of all offshore

residents? Are they certain we could afford the suggested options? What happens

to those who cannot pay?

What will happen too landing of more fragile boats ie

wood & fibre glass less weight less fuel - are these to be abandoned, these

which save our environment as there is no place to put them. Car park save

place for push bikes.

As

Bridge to

I have been parking here for 45 years In 27 years

position has worsened by land subsidence and no provision for different bikes

(motor and pedal).

Ca parks need

to be serviced by ferry and commuter tinny traffic to give householders the

option to use public transport and still get to the car.

Householders need the option to use public transport

or own boat and still get to the car.

We don’t in principle disagree with concept of paid

parking but don’t have capacity to meet such high initial outlays. Solution? Yearly lease of a guaranteed car space.

Designated reserved places for residents free by

display stickers at ferry end and paid designated visitor parking at Mona Vale

end.

Still don’t

understand why inner city residents have right to park in street to exclusion

of visitors.

How do authorities allow private business profit at

expense of people trying to access homes?

Need full time water policing not current part time.

Take over Holmport.

Onshore (residents) need to

recognise offshore community is people living everyday lives and that there is

not an unfair burden.

If lines were drawn on

current carpark 10—20 more cars would fit without any other changes.

Commercial marinas/yacht clubs offer car and boat

parking for less than options here.

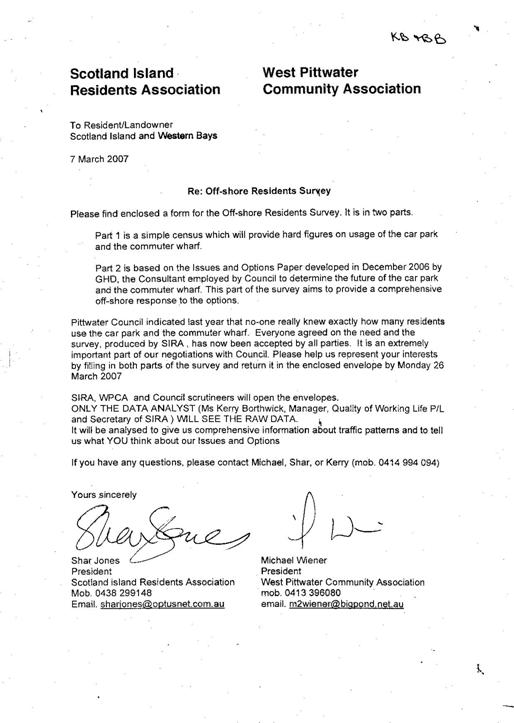

Appendix 1:

Offshore Survey Cover Letter

Offshore Survey Cover Letter